Today, Accurate Reviews experts have analyzed and evaluated some loan origination software. Based on this study, they specifically selected programs that can carry out the electronic funds transfer.

ELECTRONIC FUNDS TRANSFER: WHAT DOES IT MEAN?

Electronic Funds Transfer (EFT) refers to any capital transfer initiated through an electronic terminal, including credit card, debit card, fedwire, and point of sale (POS) transactions. It is used for both credit transfers, such as payroll payments, and debt transfers, such as mortgage payments.

Let’s look together at what are the programs that have this particular feature:

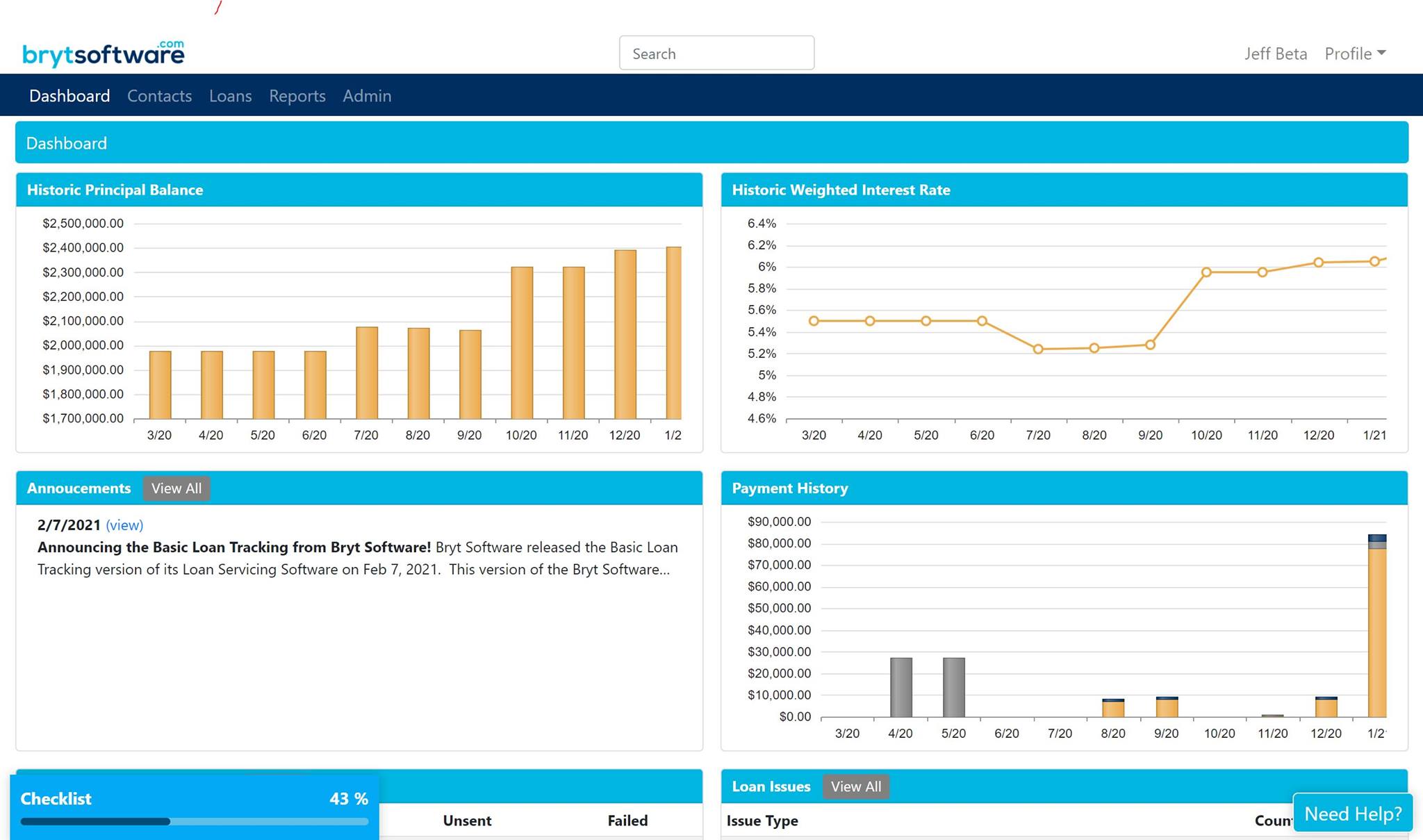

Bryt

Bryt is a loan origination software created by credit institutions for lenders, functional to optimize and simplify this work. It is an as-a-service, cloud-based program that does not require installation, updates and maintenance costs, it only requires an Internet connection. It offers an intuitive user interface, numerous features that can help professionals in the field in loan management.

By choosing Bryt you can save time, make your businesses more profitable and ensure an effortless experience for both you and your customers.

BRYT – IMAGE

Check out our review of Bryt

HES FinTech

HES FinTech is a loan origination software provider and technology consultant. Created to be the technological backbone to power the entire loan lifecycle: from creation, underwriting and assistance to collections and pipeline performance monitoring. It offers configurable software for loan creation, assistance and debt collection and deals with customized or configured software development for bank, commercial, consumer, P2P, POS, mortgage and microfinance loans. Designed with personalization and scalability in mind, HES lending software offers a unique lending experience for the financial sector, allowing clients to keep pace with changing markets and customer demands. It can be explicitly customized to reflect the brand identity and meet legal requirements.

HES FINTECH – TUTORIAL

Let’s watch this short video about this loan origination program:

Check out our review of HES FinTech

Margill Loan Manager

Margill Loan Manager is a cloud-based loan service solution that assists lenders with the maintenance of loans, lines of credit, mortgages, credits and leases. Key features include interest calculation, custom fields, data export, multi-currency support, customizable reports and revenue tracking. The application allows users to import borrower details, irregular loans and payments from Excel spreadsheets, creating custom fields and scrolling menus. The document merge tool helps teams produce contracts, letters, invoices and statements, simplifying the loan creation process. Credit teams can automate the calculation of interest and fees, as well as send payments and commission details in bulk. Managers can generate customizable reports on financial projections, transactions, payment schedules, escrow and more.

MARGILL LOAN MANAGER – TUTORIAL

Let’s see the video of the presentation of this loan origination software:

Check out our review of Margill Loan Manager

Mortgage Automator

Mortgage Automator is a loan origination software that supports lenders of all sizes and private lenders. It is an end-to-end solution that automates your business by offering customizable templates and documents, ACH / PAD payments, precise reporting system and functional communication tools.

All the activities that normally require an investment in terms of time and energy will be simplified and generated automatically giving you the opportunity to take advantage of this time by focusing on the growth of your company.

MORTGAGE AUTOMATOR – TUTORIAL

Below is a video showing how this loan program works:

Check out our review of Mortgage Automator

TurnKey Lender

TurnKey Lender is a loan origination software that automates the entire management and reporting process, ideal for banks, credit unions, finance companies, small consumer credit institutions, internal lenders, nonprofits and CDFIs . This cloud-based loan creation and management system can be customized to suit your needs and is scalable and flexible – truly fundamental and functional features of a program.

Loans will be managed quickly and easily, saving you not only time but also money.

TURNKEY LENDER – TUTORIAL

Check out our review of TurnKey Lender